Value Creation Models - Which One is Best for You?

What do you want to be when you grow up?

One of the more common questions we get asked as kids is, "What do you want to be when you grow up?" These kids are playing with roles like race car driver, artist, chef, musician, soccer player, architect, biologist, gymnast, engineer, fireman and computer scientist. No telling what these kids will actually do when they grow up. When I was young, I always wanted to build things, so I gravitated to architecture, but that didn't stick once I got to college.

The important thing is to do something you love. Don't get caught in the trap of the best pursuits are the ones with the best pay. As a society, this is one of our biggest sources of collective unhappiness. Parents tend to push their kids in this direction, instead of listening to what their kids are telling them. Did this happen to you when you were younger? Are you still working to undo a path you didn't really want to go down in life?

Let me tell you about a career fair that was held last year at my son's school. There were 40 careers represented. There was one artist, one entrepreneur, and I'm not kidding, the other 38 were doctors, lawyers, and engineers. It was a sad display of potential vocation diversity.

On a related note, I recently found this letter on Facebook from a school principal in Singapore who sent it to the student's parents before the exams. It said:

The Principal

The bottom line: there are two incredible gifts that all of us have - time and a creative mind. How do you chose to invest these gifts to generate value for society? How many of you are living your true purpose or living what someone told you would be a good thing for you to do in life? Whatever you chose, make sure you're doing it because it brings you joy, because as my coach always says, "The better you feel. The better your life works."

Life Purpose AND Financial Independence

Okay, let's assume that you have discovered and are living your life's purpose. That's awesome. The next worthy goal for everyone, is financial independence. Why? Because with financial independence, you can live your life's purpose without the need to worry about bills and expenses. You're free to spend your most precious resource, time, in alignment with the best version of yourself and your life's purpose.

Financial independence doesn't mean that you are a millionaire. Financial independence is defined as the point when your cash flow, without effort, exceeds your life expenses. Since we all have the same amount of time every day, then the best way in order to track how you're doing in this game on your way to financial independence is by dollars per hour. This is relatively easy to calculate if you earn a wage. You know how much you make per hour, but make sure you include commute time and the time you spend discussing or complaining about your job with others, 'cause all that counts.

So, if you weren't born with a trust fund, what is the path to financial independence that would allow you to really fully live your life's purpose?

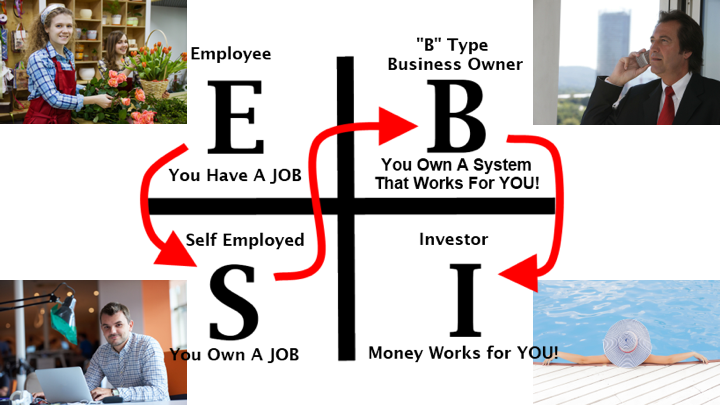

The Cashflow Quadrant

Back to the conversation of creating value. The path to financial independence is:

- Create value

- Exchange value created for cash

- Invest cash to generate passive income

Repeat until investment income exceeds expenses.

This concept is best explained by Robert Kiyosaki's, the creator of Rich Dad Poor Dad, Cashflow Quadrant (shown above - also for some fun while learning on this concept, check out the board game Cashflow 101). What follows is my interpretation, based on my experience, of Robert's Cashflow Quadrant.

EMPLOYEE

First, let's look at both ends of the path. On one end is the employee. The pros of being an employee are:

- Illusion of security

- Boundaries are clear

- Simple

- Given the bounded time obligation, it allows you to pursue other interests within the confines of your wage or salary.

What are the cons?

- The illusion of security

- Trading your hours for dollars

- No leverage

- Many constraints on your freedom because you're living most of your life waking hours in your life by someone else's rules

However, since most of the people on the planet are employees, here's a tip on trading your hours for dollars. In terms of compensation, you get what you ask for to the extent that you're still within the perceived value envelope of your position. Because it's in their own best interests, business owners and management, will almost always pay you as little as possible to get you to fulfill on your job roles. If you create value beyond your role, then ask for fair compensation. If you don't get it, then look elsewhere. Especially if you're creating great value, then somebody else is going to want you to work for them!

INVESTOR

At the other end of the path is the investor. The pros of being an investor are you get to leverage money for more money, and at this point, you're financially independent. What are the cons? Boredom. That's why it's important to know your life's purpose. At this stage of your journey, you're free to live your life's purpose to the fullest extent possible.

While you're creating value as an employee and as an investor, I believe the opportunity to create the most value is in the middle, being self employed or a business owner. There are pros and cons to each. So, let's take a closer look.

The common pro of either being self-employed or a business owner is that they both provide a vehicle to deliver your gifts and creative genius to the world in a way that the cash flow is not limited by the constraints of a wage or a salary.

BUSINESS OWNER

For a business owner the pros are that you are able to leverage other peoples time and money. The con, in my opinion and this is just my opinion, is managing employees - something I'm not really fond of doing.

SELF-EMPLOYED

On the self-employed end of the spectrum, if done right, the major pro is that it can be more flexible than being a business owner. You can still leverage other peoples money and other peoples time, via 1099 subcontractor relationships, while at the same time avoiding managing people in the traditional employee model. The con is that you could potentially be an hourly worker again, with no leverage. So, the tip here is to avoid a pure service based self-employed model, because in that model, you're really just trading your dollars for hours again.

These kinds of self-employment businesses are just hourly jobs in disguise. If you're going to provide services, offer value based packages instead of hourly rates. Build a package based model of products and/or services. In this way, you're not trading your hours for dollars in the self-employed model.

The tendency for self-employed people to in essence be hourly works is one of Robert Kiyosaki's biggest complaints about the self-employed business model. For some tips for how to do it better and for a lot more information on how to be self-employed while leveraging other peoples time and money, read Tim Ferriss' The 4-Hour Work Week. I learned an enormous amount from that book on how to improve the self-employed business model.

Finally, there are also some massive benefits to being self employed from an investment perspective, but I'm not going into those in this post. We'll cover those in a future post. So, go out and enjoy your week!

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.